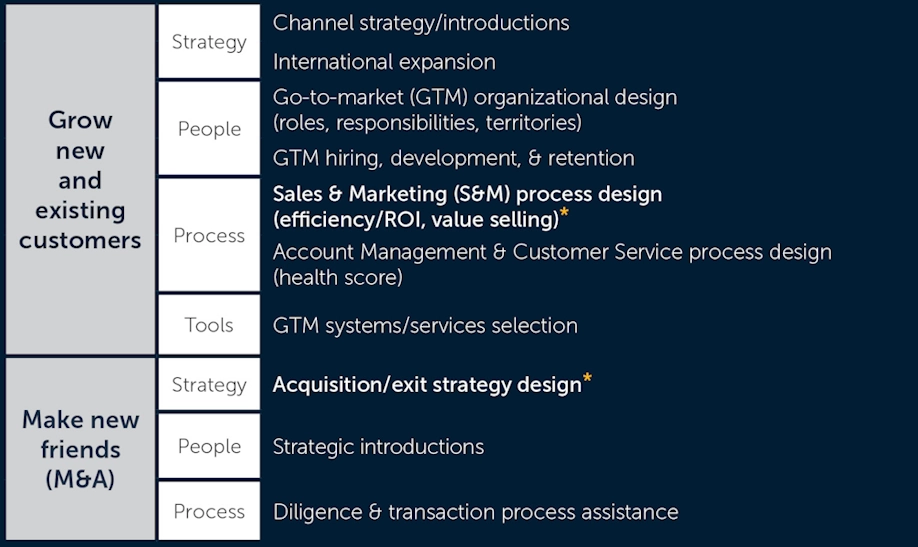

Our seventeen years of experience across 99+ portfolio companies defines our service offering to help you make your company grow faster and become more valuable, all at no cost to you.

Long-term value creator. Materially changed our trajectory with $5M+ of EBITDA creation."

I worried as a founder I would regret taking funding – but after 2 years I wouldn't want to do it without Susquehanna.

Note: CEOs of Other Firms reflects responses from 88 Founders across 71 VCs

Susquehanna Source: 2022 CEO survey (anonymous)

CEOs of Other Firms Source: https://blog.creandum.com/do-vcs-add-value-4-years-later-the-answer-remains-sometimes-49c53a8865b4

Susquehanna publishes benchmarking on go-to-market, cost, technology stack, comp and equity, and more. We work directly with our companies to create custom benchmarking specific to your company versus our portfolio and industry benchmarks. Check out our reports below.

Susquehanna has developed meaningful connections with 900+ vendors that specialize in a variety of functional topics including pricing, recruiting, international expansion, tax efficiency, and more. We connect our portfolio companies to vendors that best fit their needs and continue to support throughout all engagements.

We recognize and leverage top-talent across the portfolio. Portfolio companies benefit from advisory, executive mentorship, and access to best practices from our extended network of top decile portfolio executives (Growth Fellows) and Senior Advisors as well as Susquehanna's Portfolio Value Creation Team. The Portfolio Value Creation Team, Growth Fellows, and Senior Advisors advise portfolios on growth-related initiatives across a variety of functions.